Navigating Cases: Why You Need a Proficient Disaster Insurance Adjuster in your corner

In the after-effects of a catastrophe, navigating the complexities of insurance claims can become a challenging job, frequently exacerbated by the emotional toll of the occasion itself. A proficient disaster insurance adjuster is not simply an advocate but a crucial companion in making sure that your insurance claims are examined precisely and fairly. Their expertise in damages examination and insurance policy arrangements can substantially impact the end result of your negotiation. Many homeowners stay unaware of the complete level of these experts' capabilities and the possible mistakes of trying the process alone. Understanding these characteristics is crucial for making notified decisions.

Recognizing Catastrophe Insurers

Disaster insurance adjusters play an essential duty in the insurance policy industry, particularly in the aftermath of substantial disasters. These specialists focus on handling claims connected to large-scale occasions such as typhoons, quakes, and wildfires, which usually lead to prevalent damage. Their experience is important for efficiently examining losses and ensuring that policyholders get reasonable settlement for their claims.

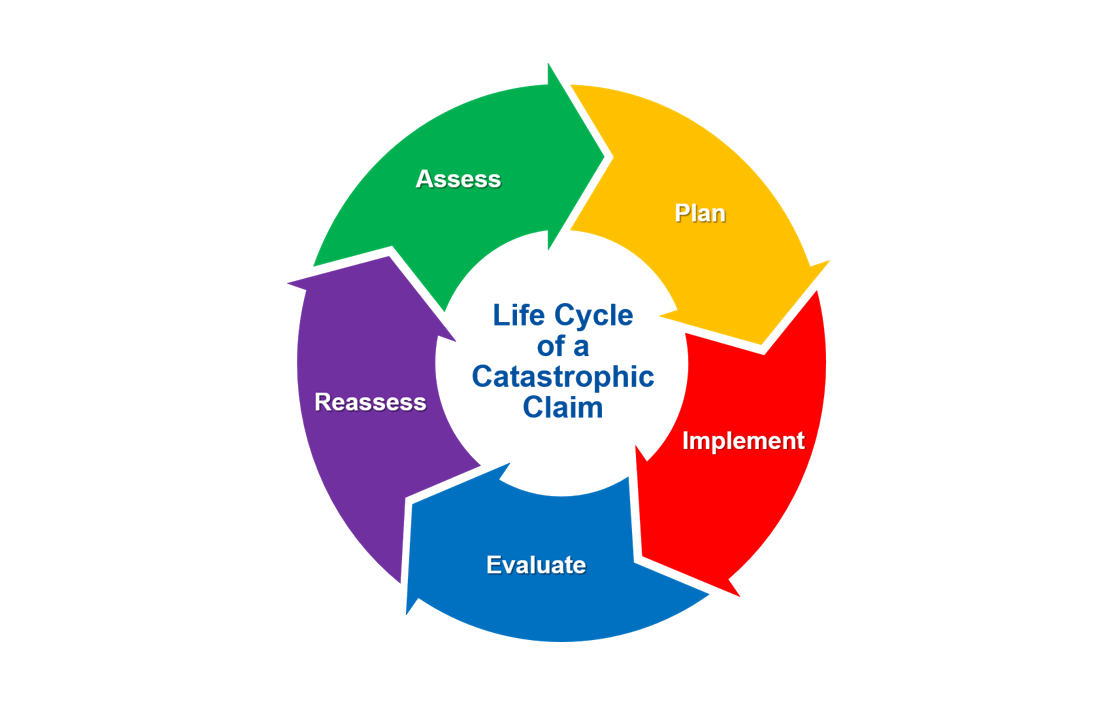

The main duty of a catastrophe adjuster is to review the extent of damage to properties, cars, and various other insured properties. This involves carrying out extensive inspections, collecting documentation, and teaming up with numerous stakeholders, including insurance policy holders, contractors, and insurer. In a lot of cases, disaster adjusters are deployed to influenced areas quickly after a catastrophe strikes, allowing them to give prompt support and speed up the claims process.

Additionally, disaster adjusters have to possess a deep understanding of insurance plans and laws to accurately translate protection terms. Their analytical abilities and interest to detail are critical in establishing the legitimacy of insurance claims and recognizing any type of possible fraudulence. By browsing the complexities of disaster-related insurance claims, catastrophe insurance adjusters play an important duty in recovering the economic stability of affected individuals and neighborhoods.

The Claims Process Explained

When a catastrophe strikes, comprehending the cases procedure is important for insurance holders seeking compensation for their losses. This procedure normally starts with alerting your insurance provider about the incident, giving them with details such as the date, time, and nature of the damage. Following this preliminary record, an adjuster will certainly be designated to examine your insurance claim, which entails checking out the loss and determining the extent of the damages.

Paperwork is an important component of the cases process. Policyholders should collect evidence, including photos, receipts, and any other significant information that sustains their insurance claim. Once the adjuster has actually performed their evaluation, they will certainly send a record to the insurance policy company. This record will certainly describe their searchings for and offer a recommendation for compensation based upon the insurance policy holder's coverage.

After the insurance company reviews the adjuster's report, they will certainly make a choice concerning the claim. Recognizing these actions can substantially aid in browsing the complexities of the insurance claims procedure.

Benefits of Employing an Insurance Adjuster

Working with an adjuster can offer various advantages for insurance policy holders browsing the cases process after a catastrophe. One of the key advantages is the proficiency that an experienced catastrophe adjuster offers the table. They possess in-depth understanding of insurance plan and insurance claim treatments, allowing them to accurately assess damages and advocate efficiently for the policyholder's rate of interests.

Furthermore, an insurer can alleviate the stress and complexity related to suing. They manage interactions with the insurer, making certain that all needed paperwork is submitted quickly and appropriately. This level of organization aids to accelerate the cases process, decreasing the moment insurance holders should wait on compensation.

Additionally, insurance adjusters are proficient at bargaining negotiations. Their experience permits them to identify all prospective problems and losses, which may not be immediately apparent to the insurance holder. This comprehensive analysis can cause a more positive settlement quantity, making certain that the insurance policy holder gets a reasonable analysis of their case.

Choosing the Right Adjuster

Choosing the appropriate insurer is vital for guaranteeing a smooth claims procedure after a calamity. When confronted with the aftermath of a disastrous event, it is important to pick an insurance adjuster that possesses the appropriate qualifications, experience, and local knowledge. A knowledgeable catastrophe adjuster must have a solid performance history of managing comparable cases and be well-versed in the ins and outs of your particular insurance coverage policy.

Once you have a shortlist, conduct meetings to determine their communication abilities, responsiveness, and determination to promote for your passions. An experienced insurance adjuster must be clear concerning the insurance claims procedure and provide a clear rundown of their fees. Lastly, trust your impulses-- choose an adjuster with whom you feel certain and comfortable, as this collaboration can substantially impact the result of your insurance claim.

Common Myths Exposed

Misunderstandings about disaster insurers can lead to complication and impede the cases process. One usual myth is that catastrophe insurance adjusters work solely for insurance coverage business. In truth, several insurance adjusters are independent professionals who advocate for insurance policy holders, ensuring fair evaluations and settlements.

An his explanation additional misunderstanding is that working with a disaster adjuster is an unnecessary expense. While it is real that insurers bill fees, their experience can useful source usually lead to greater insurance claim settlements that far outweigh their expenses, ultimately benefiting the policyholder.

Some people believe that all insurance claims will certainly be paid completely, despite the scenario. Insurance coverage policies often include particular terms and problems that might limit coverage. Understanding these nuances is essential, and a skilled insurer can assist browse this complexity.

Conclusion

In summary, the participation of a competent catastrophe insurer dramatically improves the claims procedure complying with a disaster. Their knowledge in damage analysis, policy analysis, and arrangement with insurers guarantees that individuals obtain equitable settlement for losses incurred. By alleviating the intricacies related to claims, these professionals not only expedite the process yet likewise give vital support throughout challenging times. Eventually, the choice to engage a disaster adjuster can have a profound influence on the result of insurance policy claims. see this here

In many situations, disaster insurers are deployed to affected areas soon after a calamity strikes, permitting them to provide timely help and quicken the claims process. - catastrophe claims

A proficient disaster adjuster should have a solid track record of dealing with similar insurance claims and be skilled in the ins and outs of your specific insurance policy.

Begin by researching potential adjusters, looking for professional classifications such as Qualified Adjuster or Accredited Claims Adjuster. catastrophe claims.Misunderstandings about catastrophe insurers can lead to complication and impede the claims process.In summary, the participation of a knowledgeable catastrophe insurer dramatically enhances the claims process complying with a calamity